Over the last several years there has been increased popularity and attention given to “leasing” as a financing alternative over the outright purchase alternative when acquiring an automobile.

There’s no question that leasing offers some significant benefits over an outright purchase, otherwise it wouldn’t be so popular. This blog, however, is intended to be a wake-up call for those who don’t fully comprehend some of the negative aspects and consequences of leasing a car instead of purchasing a car outright.

Probably the most obvious benefit of a lease is that the cash out for down payment (or what’s referred to as “what’s due at initial lease signing” in lease jargon) and the monthly payments is significantly less than what the monthly payments and down payment would be when using the purchase-financing alternative.

There’s an explanation for why total cash out under the lease scenario is less than total cash out under the purchase scenario. Under the lease scenario the purchaser (lessee) makes payments to merely “rent” the car -- at no point in time during the lease term does the purchaser take title to the car. The lessee acquires the right to use, not own, the vehicle in return for the monthly payments that he or she makes to the seller. Under the lease scenario the lessee’s payments are just sufficient to “reimburse” the lessor for the car’s depreciation, which is less than what it would take to payoff the amount of “principal.”

On the other hand, under the purchase scenario the buyer pays a higher monthly payment because the payments have to be sufficient to payoff more than just depreciation so that the buyer can take title to the car by the time the last payment is made to the seller.

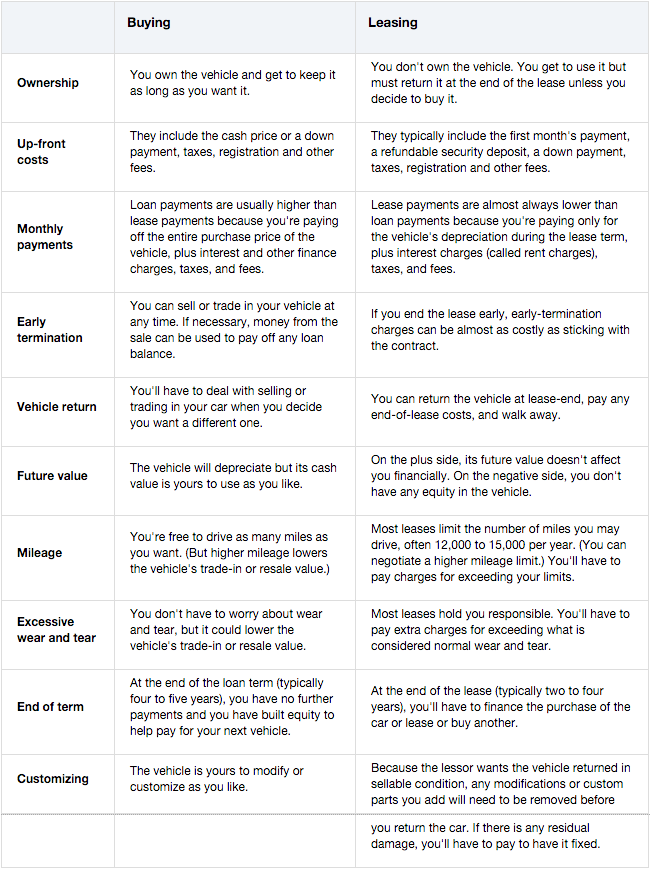

Does a lease make sense for you? The size of the monthly payments is only one of several factors that need to be weighed when considering taking out a lease. The answer to the question of whether or not an auto lease is right for you is very much dependent on a mix of personal factors.

The following table, which compares the purchase and lease financing choices, is made available by Consumer Reports:

If you think you might want to pursue a car purchase by using lease financing then check out the Wall Street Journal article at How to Lease a Car and Get the Best Deal.

A potential benefit from leasing is what happens when the residual value of the car at the end of the lease is dramatically less than what the market value of the car is worth. In such cases the lessee/buyer can get an outrageously good deal by paying off the residual value and keeping the car.

Happy trails with your new car!