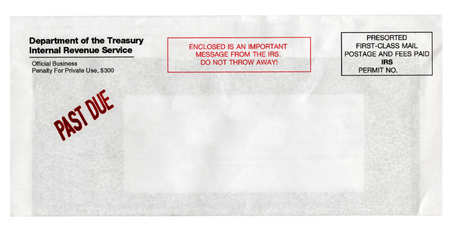

Deal with it now!

If you've received a notice or letter from the IRS, it’s best to deal with it right away. The more letters they send out the harder they are to deal with.

Don't Panic.

Do not panic, whatever you do. The IRS sends out millions of these and sometimes they can be just to verify a specific issue about your claim. And if you are asked to pay an additional amount, don’t pay it right away unless you're sure you owe it. The government has been known to make mistakes. That’s why it’s important to have someone qualified like us review the notice so we can make sure you get to keep as much of your money as you can and fulfill your legal obligations.

Let us take a look.

Keep in mind, these letters look daunting because they are required by law to be filled with legalese keeping you abreast of your rights. Of course, this can confuse the intent of the letter at times. Again, this is what we do so have us look at the notice you receive and take away the anxiety the IRS can cause sometimes.