Beneficial Ownership Information Reporting

There is a new requirement by the Financial Crimes Enforcement Network, or FinCEN, for businesses to report information about their beneficial owners (i.e., the individuals who ultimately own or control the company). The purpose of this reporting requirement is to assist the U.S. government with making it harder for bad actors to hide or benefit from their ill-gotten gains through shell companies or other structures.

Which companies are required to report beneficial ownership information:

- Corporations, limited liability companies and any other entities created by the filing of a document with a secretary of state or any similar office in the U.S.

- Foreign reporting companies formed under the law of a foreign country that have registered to do business in the U.S by the filing of a document with the secretary of state or similar office.

Below is what information will need to be reported and when the initial report is due. There is a list of exemptions at the bottom. If you would like us to prepare this for you, we will charge $XXX.

For reporting companies registered BEFORE January 1, 2024:

- Initial report must be filed by January 1, 2025

- Not required to report company applicants

For reporting companies registered AFTER January 1, 2024:

- Initial report must be filed within 90 days of receiving actual notice of registration

- Required to report company applicants (the individual who directly filed the creation documents for the company, and if applicable, a second person who is primarily responsible for the filing of the documents)

Who is a beneficial owner? (Only needs to meet one condition)

- An individual who either directly or indirectly:

- Exercises substantial control over the reporting company.

- Senior Officers

- Authority to appoint or remove officers

- Important decision-makers

- Any other form of substantial control

- Exercises substantial control over the reporting company.

- Owns or controls at least 25% of the ownership interest

What information is needed to be reported:

- Reporting Company

- Full Legal Name

- Any Trade Name

- Complete current U.S. address

- State, Tribal, or foreign jurisdiction of information

- For Foreign companies only- State or Tribal jurisdiction of first registration

- IRS Taxpayer Identification Number (Including an Employer Identification Number)

- Each Beneficial Owner and Company Applicant

- Full legal name

- Date of Birth

- Complete current address

- Unique identifying number and issuing jurisdiction form, and image of one of the following:

- U.S. Passport

- State Driver’s License

- ID issued by a state, local government, or tribe

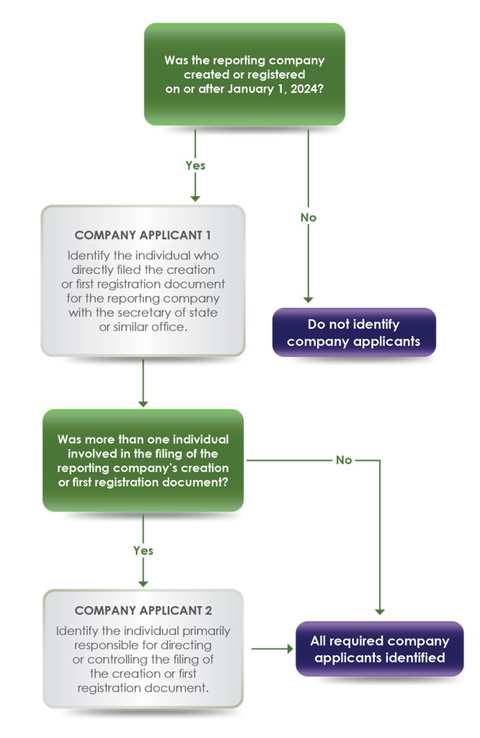

Information about Company Applicants (Flow Chart Below)

- Direct Filer

- The individual who directly filed the document to register the reporting company.

- Directs or controls the filing action

- The individual who was primarily responsible for directing or controlling the filing of the first registration document.

General Exemption for a “Large Operating Company” (Must meet all conditions)

- Employs more than 20 full-time employees

- More than $5,000,000 in gross receipts or sales in the U.S.

- Has an operating presence at a physical office in the U.S.

Exempt individuals

- Minor Child

- Nominee, intermediary, custodian, or agent

- Employee

- Inheritor

- Creditor

Filing Frequency:

- If there is any change to the required information about your company or its beneficial owners, your company must file an updated report no later than 30 days after the date of the change.

How to file the report:

- The report will be filed electronically through a secure filing system available via FinCEN’s website.

- Click this link and then click “Prepare BOIR” to begin filing- https://boiefiling.fincen.gov/fileboir

For more information, please contact us or visit fincen.gov/boi

List of exempt companies

Company Applicant Flow Chart